Calculate payroll withholding 2023

The new W-4 system. Note that unlike Paid Family and Medical Leave premium contributions do not top out at the taxable maximum for Social Security.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

While ISOs can offer a valuable opportunity to participate in your companys growth and profits there are tax implications you should be aware of.

. These employer stock options are often awarded at a discount or a fixed price to buy stock in the. Tax Return Access. Non-qualified stock options aka non-statutory options or NSOs.

Terms and conditions may vary and are subject to change without notice. If you can pay off your balance within 120 days it wont cost you anything to set up an installment plan. This document is a withholding schedule made by the Commissioner of Taxation in accordance with sections 15-25 and 15-30 of Schedule 1 to the Taxation Administration Act 1953 TAA.

This calculator is integrated with a W-4 Form Tax withholding feature. It will be updated with 2023 tax year data as soon the data is available from the IRS. This estimate is illustrative only and is derived from the differences between tax withholding and annual tax and may vary from your actual tax return.

Payday and state PIT withholding. May 2 2022 August 1 2022 October 31 2022 January 31 2023. Some employers use Incentive Stock Options ISOs as a way to attract and retain employees.

14 August for large withholders annual withholding more than 1 million or those lodging without registered agent involvement. If your profit exceeds the 250000 or 500000 limit the excess is typically reported as a capital gain on Schedule D. The two main types of stock options you might receive from your employer are.

Tax Return Access. For payments made on or after 1 July 2022. 10 12 22 24 32 35 and 37.

Input your current loan amount as it is today. Seq Regulations - Part 1007000 etseq Electronic Services. The IRS announced that they will be providing Covid tax relief for certain 2019 and 2020 Returns due to the pandemic.

Accumulated State PIT Withholding Payday PIT and SDI Deposit Due By California Deposit Schedule. File your W-2s. Terms and conditions may vary and are subject to change without notice.

If you acquire ownership of a home as part. If filed online you can use a payroll report that contains Name SSN Gross Amount Paid and Number of Hours Worked in a Quarter to balance prior quarters. The IRS will be issuing refunds of up to 12 billion to a total of 16 million qualifying individual taxpayers Form 1040 and businesses Form 1120 who filed their 2019 or 2020 taxes late.

FSET For Large EmployersPayroll Companies. Social Media Sharing Cookies are third-party cookies that are used when you share information using a social media sharing button or like button on our website or you link your account or engage with our content on or through a social networking site such as. Additional income that might not be subject to withholding like dividends or retirement income.

15-T for an employee with a Form W-4 from 2019 or earlier or you may use the optional computational bridge to treat 2019 or earlier Forms W-4 as if they were 2020 or later Forms W-4 for. Incentive stock options also known as statutory or qualified options or ISOs and. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

The eligible new assets must be first held and first used or installed ready for use for a taxable purpose between 730pm AEDT on 6 October 2020 and 30 June 2023. Itemized deductions like mortgage interest and charitable contributions that will exceed your standard deduction. Any extra withholding that you would like to withhold each pay period.

Calculate the total premium amount for each of your employees. We recommend that you use the Payroll Deductions Online Calculator PDOC the publication T4032 Payroll Deductions Tables or the publication T4008 Payroll Deductions Supplementary Tables and the formulas in this guide for withholding starting with your first payroll in July 2022. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

At the time of publishing these proposed changes were not law. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. 30 September for payers who are using a registered agent to lodge excluding large withholders.

For businesses with an aggregated turnover of less than 50 million temporary full expensing also applies to the business portion of eligible second-hand depreciating assets. It applies to withholding payments covered by section 12-35 of Schedule 1 to the TAA. Aims to reduce the complexity of calculating how much to withhold and increase the transparency and accuracy of the withholding system.

You will use the withholding methods described in Pub. Well help you understand ISOs and fill you in on important timetables that affect your tax liability so you can optimize the value of. How to lodge a PAYG withholding payment summary annual report for payments not reported and finalised in STP.

Use this tool to calculate how long it will take to repay your loan. The premium for 2023 is 058 percent of an employees gross wages so. Date of first pay.

Fees for IRS installment plans. This is a more simplified payroll deductions calculator. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023.

Form 5208B Quarterly Unemployment Insurance Wage Detail. The amount of payroll expense dollar thresholds SMC 538030 The amount of the exemption SMC 538040A1 The amounts calculated shall be rounded to the nearest whole dollar. Gross wages x 0058 total premium.

Generally you must withhold Illinois Income Tax if you are required to withhold or have a voluntary agreement to withhold federal income tax from payments you. If you cannot pay off your balance within 120 days setting up a direct debit payment plan online will cost 31 or 107 if set up by phone mail or in-person. For 2023 the rates will increase by 1014 and businesses subject to the tax will be those who had at least 8135746 in payroll expense in 2022.

Know the federal and state payroll tax requirements to make your payroll tax deposits on time. 183 days or more during the period 1 July 2021 30 June 2023 including at least one day in 202223 and you did not claim a zone tax offset in your 202122 tax return. We also offer a 2020 version of this calculator.

Key Takeaways If you owned and lived in the home for a total of two of the five years before the sale then up to 250000 of profit is tax-free or up to 500000 if you are married and file a joint return. Statutory - 35 ILCS 5701 et. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

If you live in a zone for less than 183 days in 202223 you may still be able to claim a tax offset if you meet each of the following 3 conditions. The new W-4 is an attempt to be more accurate in estimating your tax withholding so that you can get closer to owing 0 and getting a 0 refund when you prepare your tax return. Important IRS penalty relief update from August 26 2022.

Receiving an employer stock option. IT is Income Taxes. Schedule 15 Tax table for working holiday makers.

2022 Income Tax Brackets Taxes Due April 2023 Or October 2023 With An Extension For the 2022 tax year there are also seven federal tax brackets.

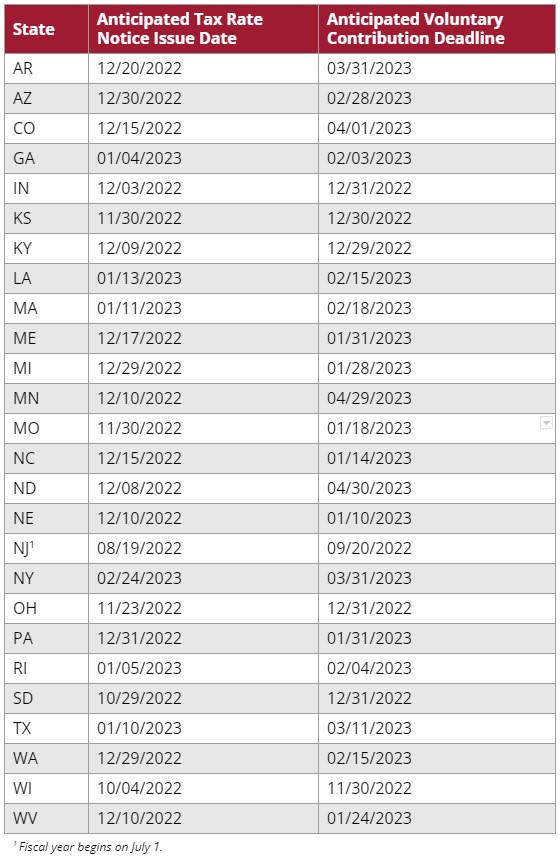

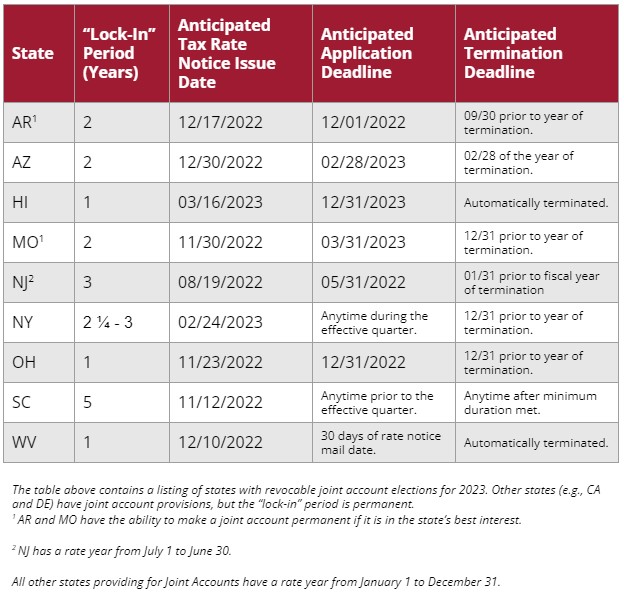

Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Who S Ready For 6 Big Changes To Social Security In 2023 The Motley Fool

Social Security What Is The Wage Base For 2023 Gobankingrates

Tax Withholding Estimator 2022 2023 Federal Income Tax Zrivo

Irs Finalizes 2022 Federal Tax Withholding Guidance And Forms Ice Miller Llp Insights

Strategies To Help Reduce Sui Tax Burdens In 2023 And Beyond

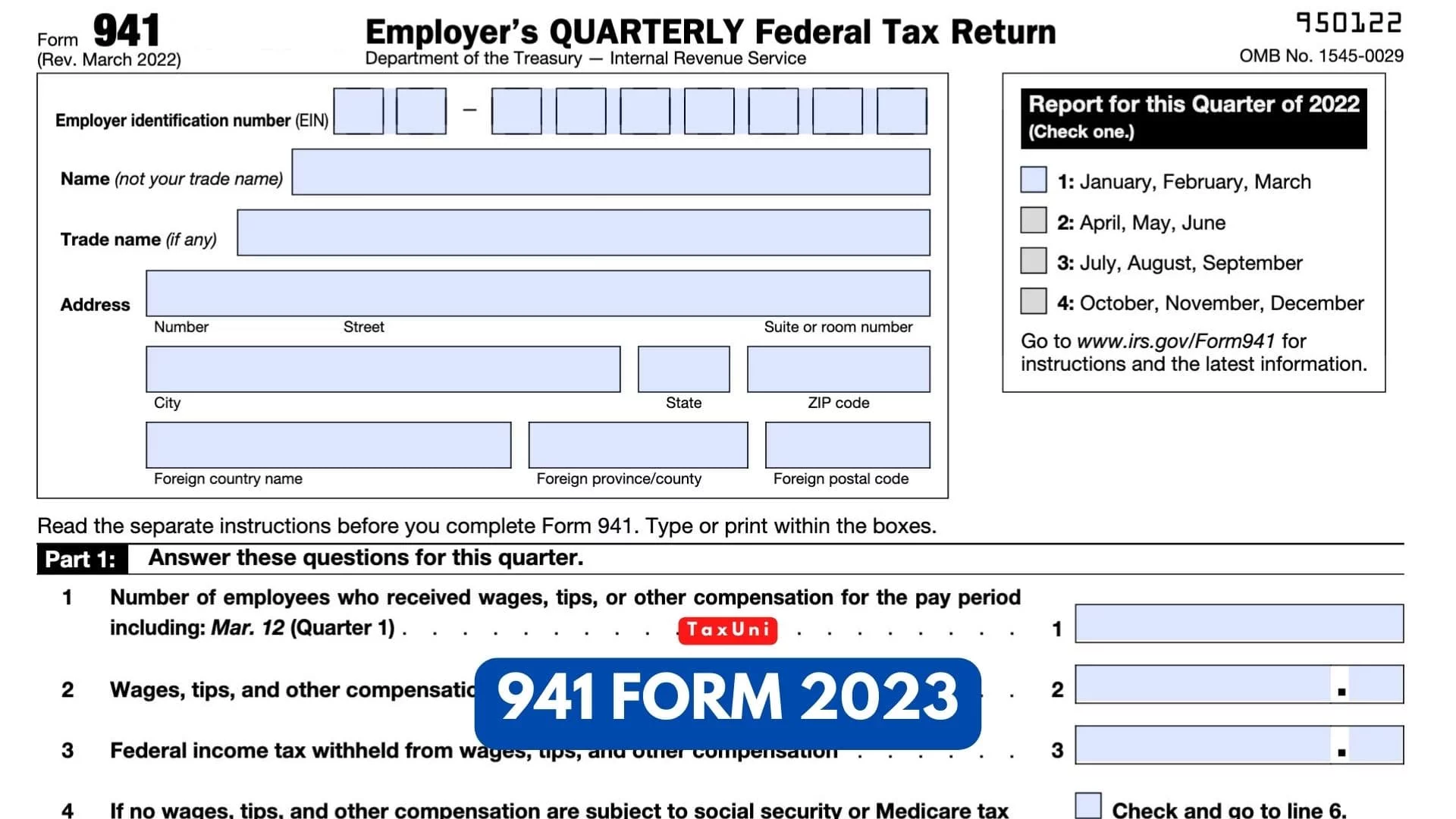

941 Form 2023

New 2023 Irs Retirement Plan Contribution Limits Including 401 K Ira White Coat Investor

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Social Security Fund Would Be Empty By 2023 If Payroll Taxes Were Cut Actuary Estimates

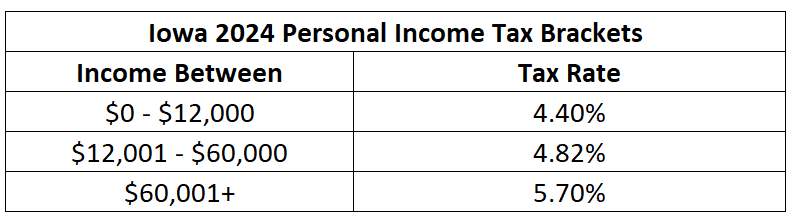

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

The 1 Social Security Change You Can Bank On For 2023 The Motley Fool

Irs Issues Revised And New Withholding Certificates Optional To Use In 2022 Required In 2023 Wolters Kluwer

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

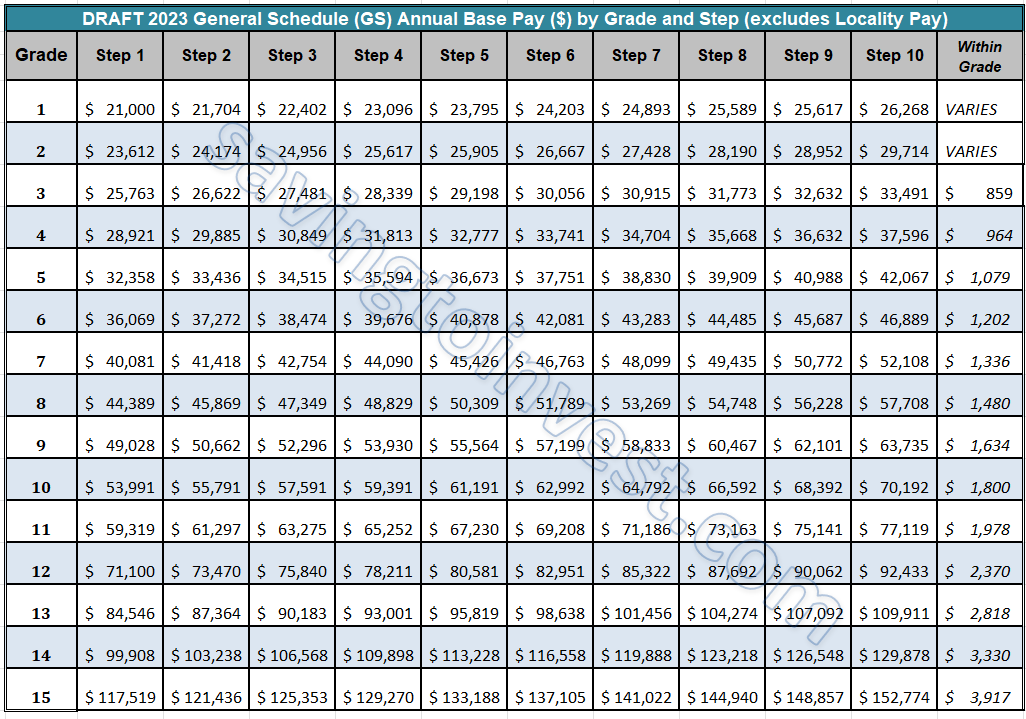

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Form 941 For 2023